About five years ago, I allocated part of my portfolio to peer-to-peer lending on Prosper. At the start, advertised borrower rates of 8–12% looked attractive and seemed like a good diversifier.

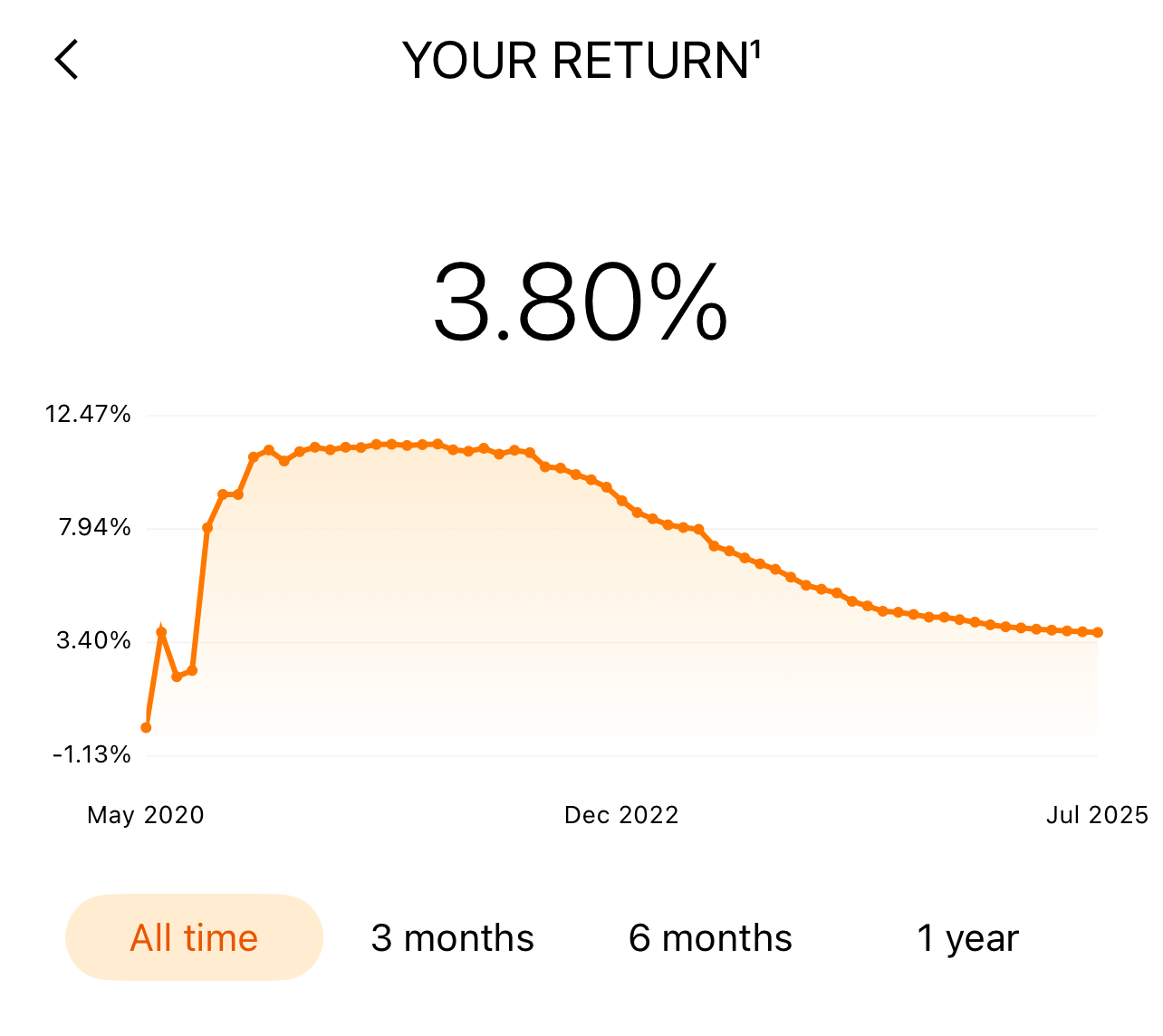

Over time, reality was different. Defaults, late payments, servicing fees, and early repayments steadily chipped away at returns. Idle cash between allocations created additional drag. As the loans aged, my return curve peaked near double digits, then steadily fell.

In the end, my all-time return settled around 3.8%—a far cry from the advertised yields. That doesn’t make Prosper a bad platform, but it highlights the gap between headline rates and what investors actually keep after defaults, fees, and taxes.

Key Takeaways

- Defaults and servicing fees are the biggest drag on returns.

- Prepayments cap interest earned and create reinvestment risk.

- Idle cash between notes reduces annualized yield.

- Ordinary income tax treatment lowers net take-home returns.

Final Word

For me, Prosper was a useful experiment but not a long-term core holding. A steady 3–4% return is decent compared to a bank account, but not enough to justify the risk versus other investments.