One of the best parts about M1 Finance is the ability to create your own “custom ETF.” Instead of being locked into a traditional index fund, I can build a pie of stocks that reflect my strategy and automatically invest into it through dollar-cost averaging.

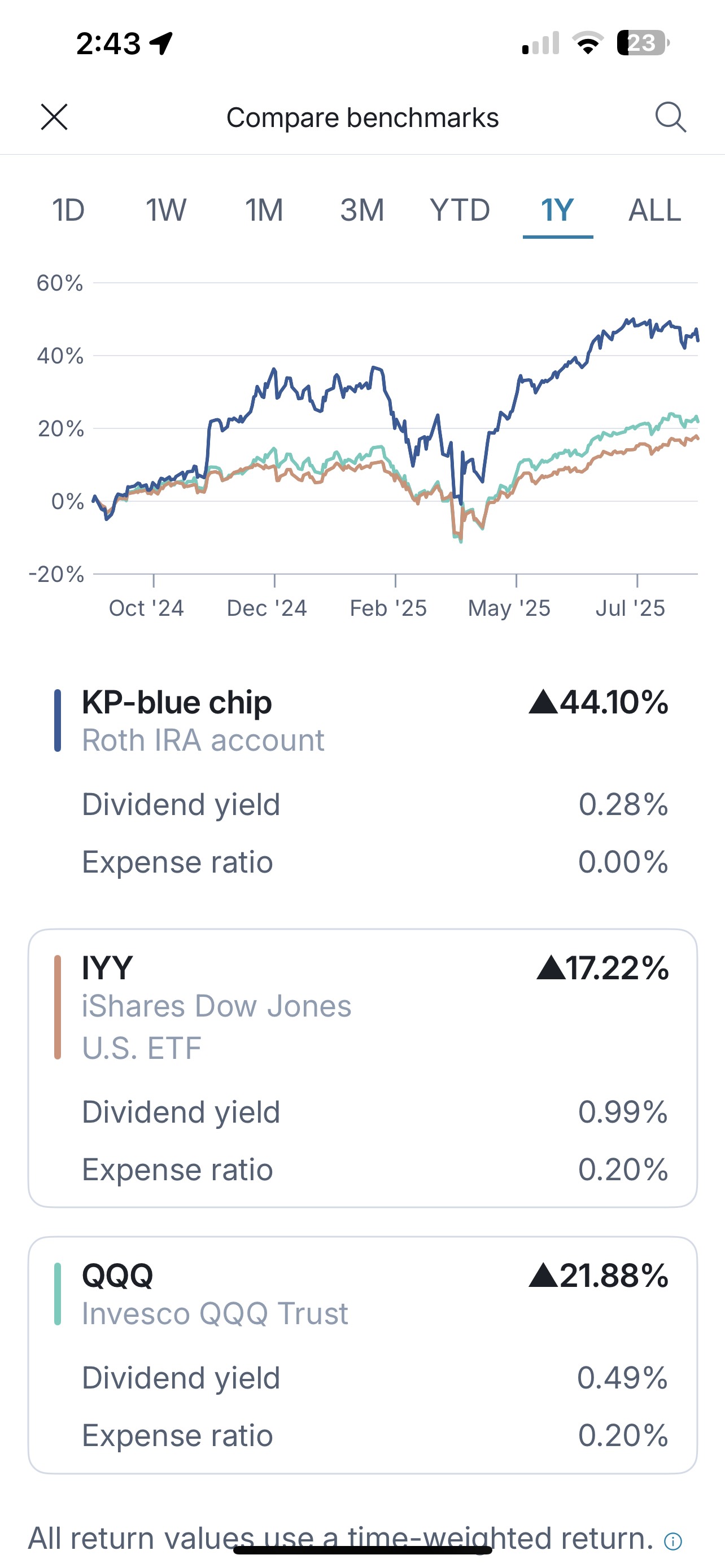

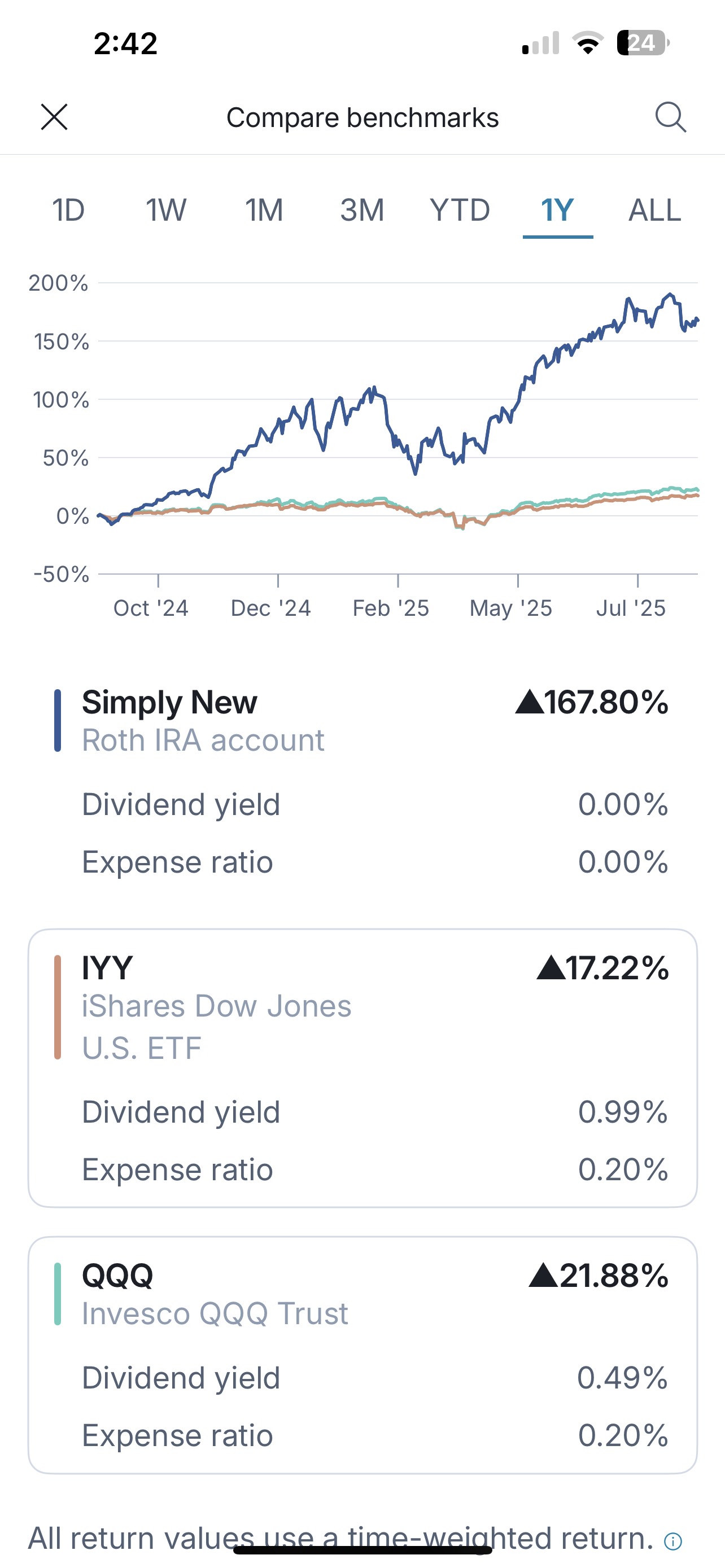

I’ve experimented with two main pies in my Roth IRA account — KP-blue chip and Simply New. Both are structured differently, but share the same discipline of consistent contributions and flexible rebalancing. Here’s how their performance stacks up against traditional benchmarks like the S&P 500 ETF (IYY) and Nasdaq 100 ETF (QQQ).

Performance: KP-blue chip

Performance: Simply New

These results show the benefit of being flexible with allocation. Both pies significantly outperformed traditional benchmarks over the past year, though each carries different levels of risk. The core discipline is still dollar-cost averaging — consistent contributions, regardless of short-term volatility.

Key Takeaways

- M1 Finance lets you build a portfolio like your own ETF.

- Dollar-cost averaging removes stress about timing the market.

- You can add, remove, or rebalance slices anytime.

- Custom ETFs can outperform benchmarks, but they also carry concentrated risks.

What’s Next

In this post, I shared performance comparisons for my pies. In my next blog ← Try it, I’ll explain my strategy for picking and replacing stocks inside these structures — the rules I use to decide when to swap holdings and how I balance risk and growth.

Comments