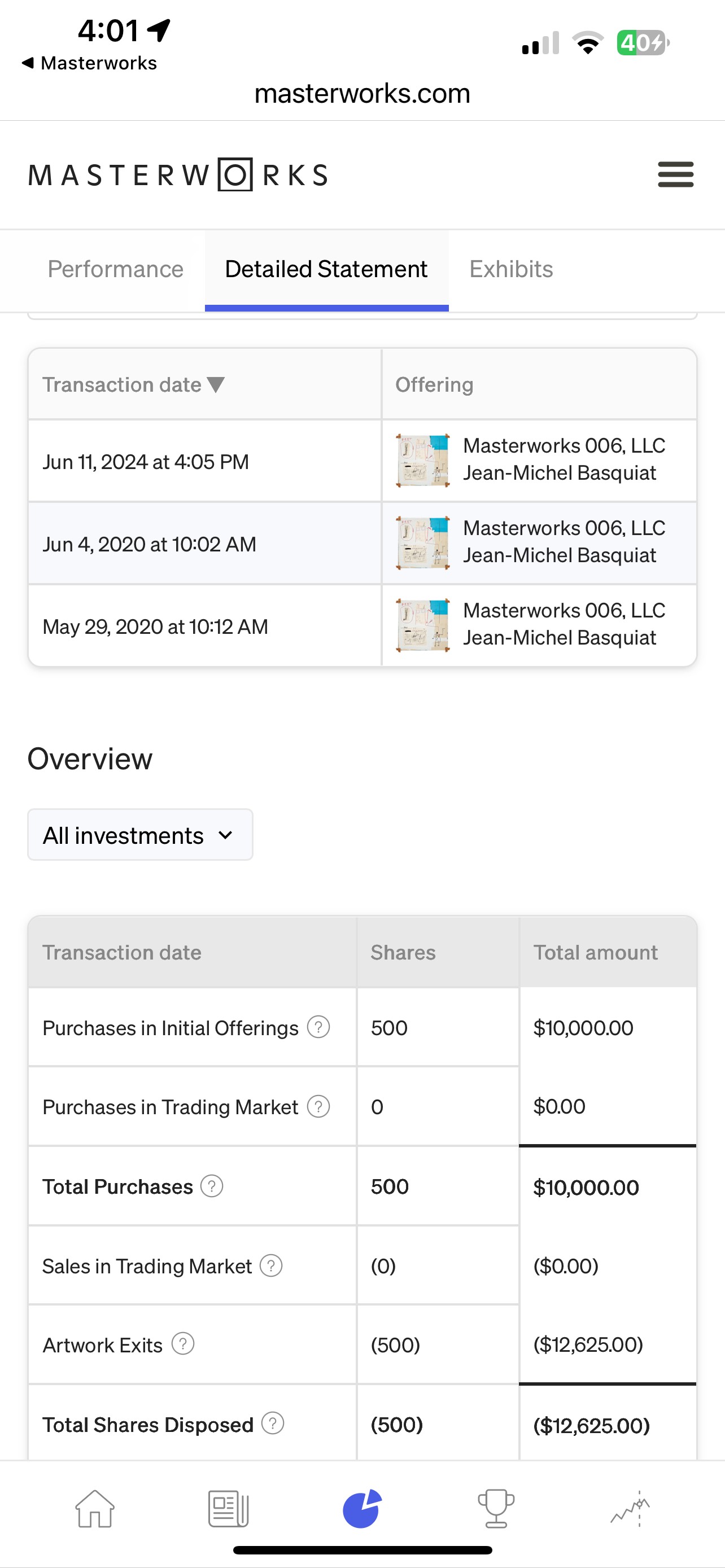

In 2020, I decided to try something different: investing in artwork through a platform called Masterworks. The idea is simple—you can buy fractional shares of famous paintings, making the art market accessible without needing millions to purchase a piece outright.

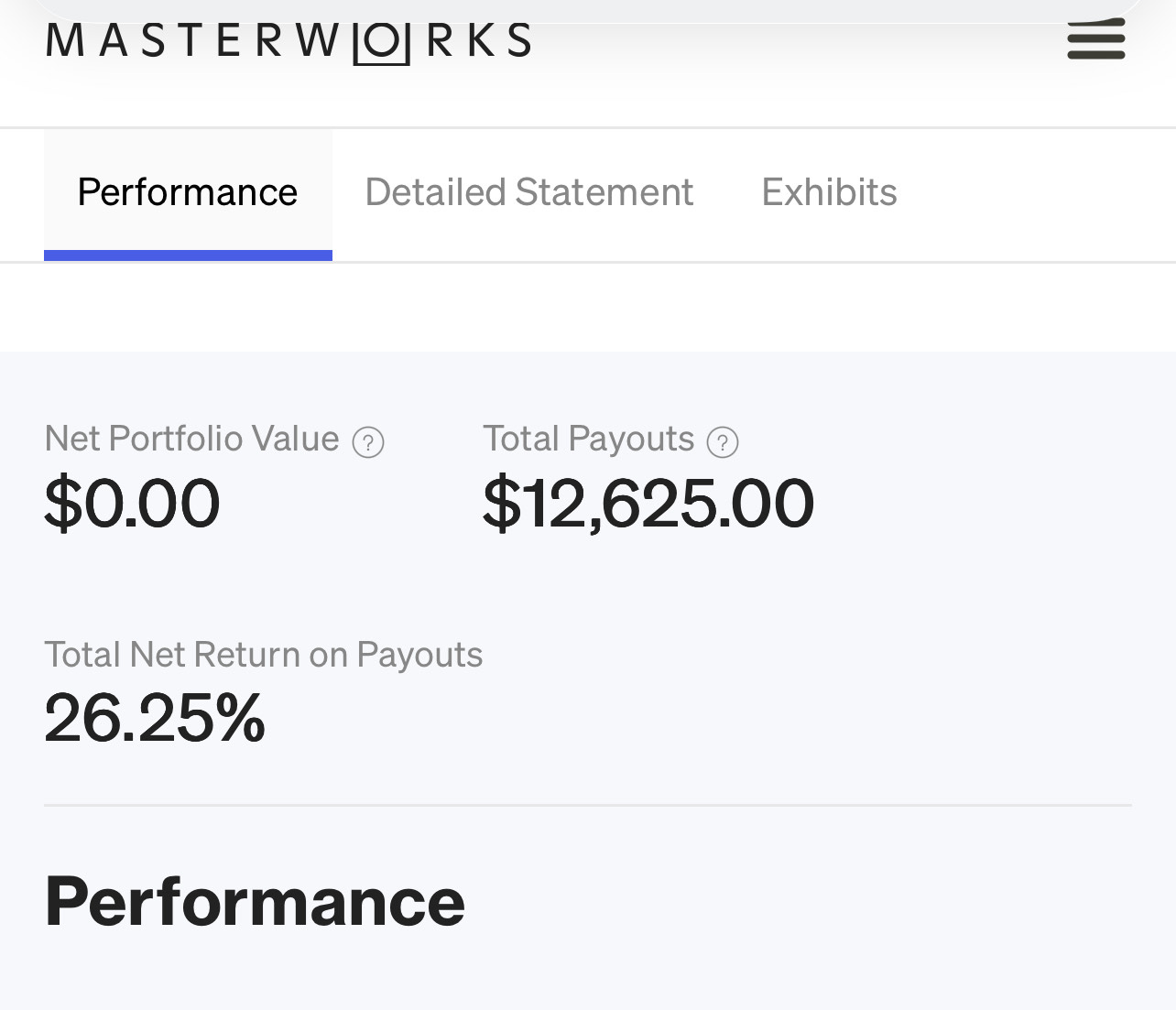

I purchased a portion of a Jean-Michel Basquiat painting and held it until 2024. When the artwork was sold, my portion came out with a profit of 26.25%. On the surface, that looks impressive, but over four years the annualized return wasn’t quite as strong as I had hoped.

The Good

- Easy to buy into well-known, high-value artwork.

- The platform is simple to use and transparent with updates.

- Liquidity event (sale) provided a real return, not just paper gains.

The Not-So-Good

- 26.25% over four years sounds better than it really is when annualized.

- I don’t have expertise in art, so I had no way of knowing which pieces might perform best.

- Returns are highly dependent on when the art sells and at what price.

What I Learned

Overall, I’m glad I walked away with a profit, but I see Masterworks as more of a long-term alternative investment than a quick win. The platform itself even emphasizes that—it won’t let you sell until the underlying art is ready to be sold. This makes it feel very different from stocks or even real estate.

For me, this was a fun experiment and a chance to diversify into something unconventional. I don’t plan to become an art investor, but I value the experience and the small win it gave me.

Disclaimer: I don’t have any clue about art. My decision was purely experimental, not based on expertise.